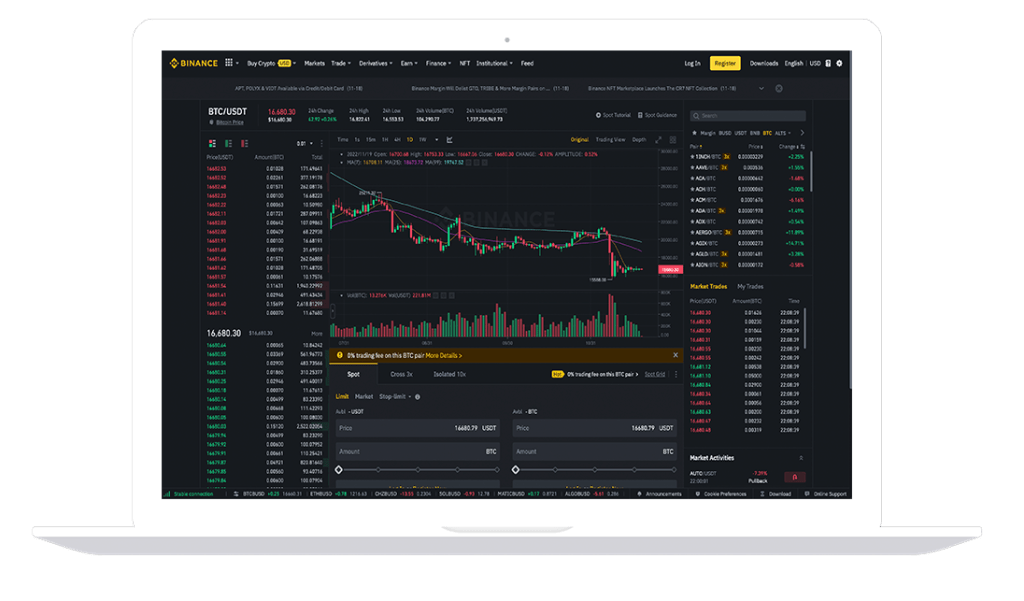

Abakus accumulates live trading data from multiple platforms into one unified deep learning database.

Abakus has a neural network analyzing real time Orderbook data allowing for real time risk mitigation and automation.

Abakus is built with algorithms to achieve the optimum utility output for each feature of the software.

Abakus is a proficient OrderBook and data accumulation software using Machine Learning to achieve full trade automation

Abakus makes calculations when humans can’t.

Abakus’s validation manifest from machine learning of real time orderbook BID and ASK prices with live data accumulated from multiple exchanges and unified into a deep learning database and analyzed by our A.I. to achieve automation. Abakus ‘s use of machine learning provides a cutting edge trading tool to identify directional movements and wide BID and ASK spreads in the marketplace. Numbers don’t lie!

is to offer the most proficient automated trading tool with proven metrics to bring solutions for consistent returns in the digital asset marketplace and new capital markets.

Day Trade on Binance and Coinbase with Abakus API’s

Artificial intelligent trading achieved through machine learning techniques of Real time OrderBook Bid/Ask prices may be relatively new in the capital markets, but it is certainly clear that the tide has turned. Systematic traders and hedge funds may have been the early adopters of these technologies, but today, more traditional players such as day traders, asset owners, investment managers and wealth managers are pouring resources into such data-driven signals/strategies.

Abakus’s unique blend of Real Time machine learning capabilities, coupled with its proprietary market structure analytics and unmatched options expertise, yields highly scalable, well diversified signals that generate alpha, help limit market correlations, and mitigate losses.